Three Key Trends Shaping Pricing for Innovative Non-VBP Medical Devices in China

Public and private hospitals represent many innovative MedTech players' most important distribution channels.

However, unlike in most developed markets, China’s regulated medical service prices and distinctive provincial procurement systems can profoundly affect the pricing and commercialization of innovative medical devices. This article examines three emerging trends that will be pivotal in shaping the pricing strategies for newly launched and early-lifecycle devices. Proactively addressing these trends is crucial for successfully navigating China's complex and evolving hospital market.

Trend #1: Managing Medical Service Costs: Emphasis on High-Value Medical Consumables and IVD Reagent Pricing

One key goal of China's ongoing medical service pricing reform is to separate technical service costs from the costs of medical consumables.

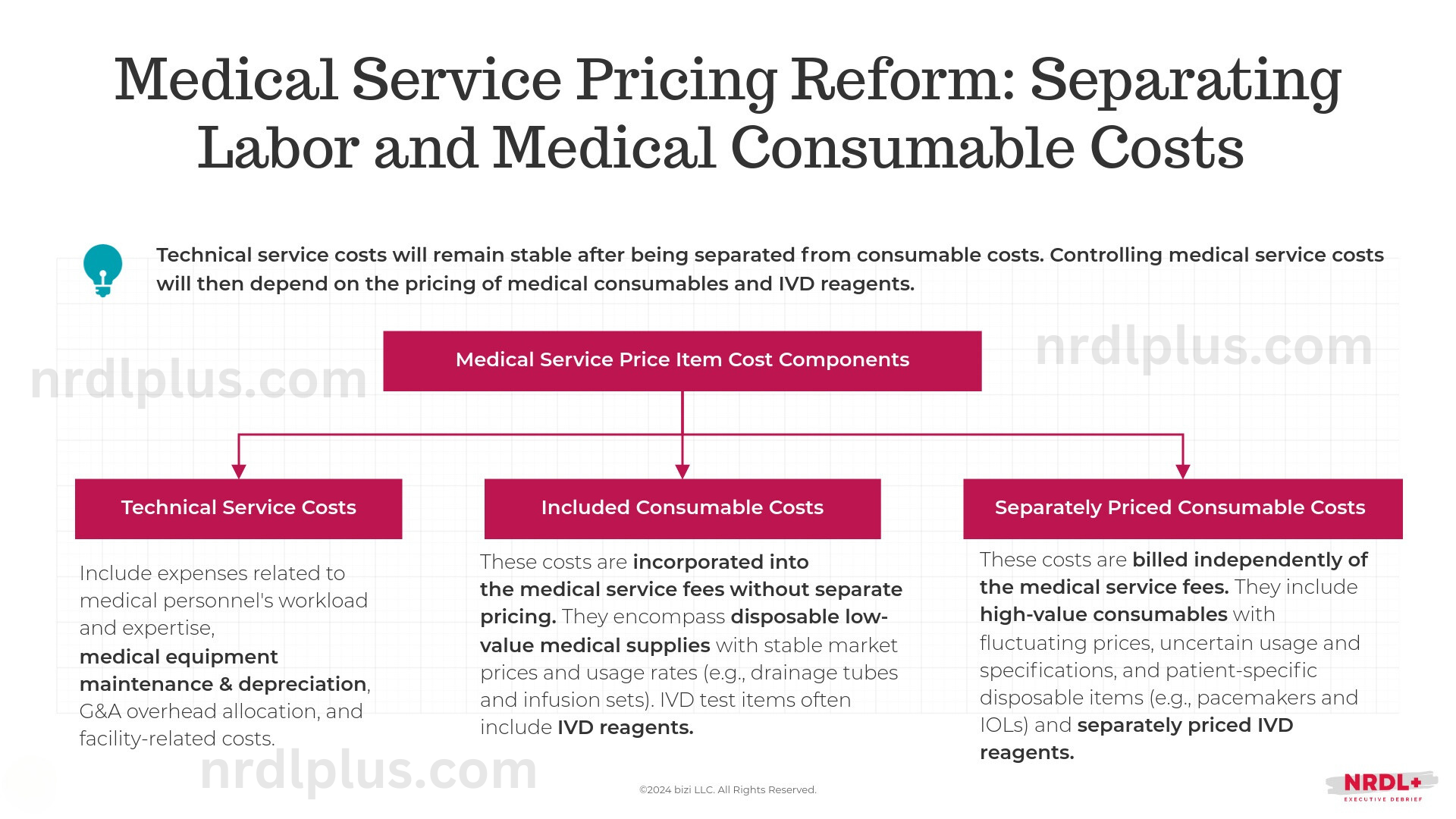

Medical service price items, the fundamental billing units used by Chinese not-for-profit hospitals, particularly those closely linked to or dependent on the use of medical devices, consist of three components:

- Technical service costs comprise expenses associated with the workload and expertise of medical personnel, medical equipment maintenance and depreciation, general and administrative overhead allocation, and facility-related expenses.

- The "included consumables" cover disposable, low-cost medical supplies with stable market prices and consistent usage rates, such as drainage tubes and infusion sets. IVD test items typically include IVD reagents. These costs are not priced separately and are incorporated into the overall medical service fees.

- Separately priced consumables are charged outside of the medical service fees. These include high-value medical consumables with fluctuating prices, uncertain usage or specifications, and patient-specific disposable items like pacemakers and intraocular lenses. Additionally, this category includes IVD reagents that are billed separately.

After separating technical service costs and medical consumables costs, the result will be that "consumables costs change, yet technical service costs do not." In other words, controlling medical service costs will then depend on the pricing of medical consumables.

Similarly, as technical service costs stabilize, managing overall costs for IVD tests will increasingly rely on reagent pricing, regardless of whether the reagent costs are charged separately or included in the medical service costs without separate pricing.

These heightened emphases on managing consumable and IVD reagent costs will likely broaden VBPs, further extending to non-BMI-covered items and areas with limited competition and fewer strong domestic alternatives. However, this expansion isn't necessarily negative. In areas with lower domestic substitution rates, VBP price reductions are typically more moderate, offering later market entrants the chance to capture significant market share.

Additionally, manufacturers should monitor new launch pricing policies for innovative medical products, often linked to provincial procurement listing applications, and adjust their strategies accordingly.

Trend #2: The Rise of Value-Based Approval and Pricing for New Medical Service Price Items

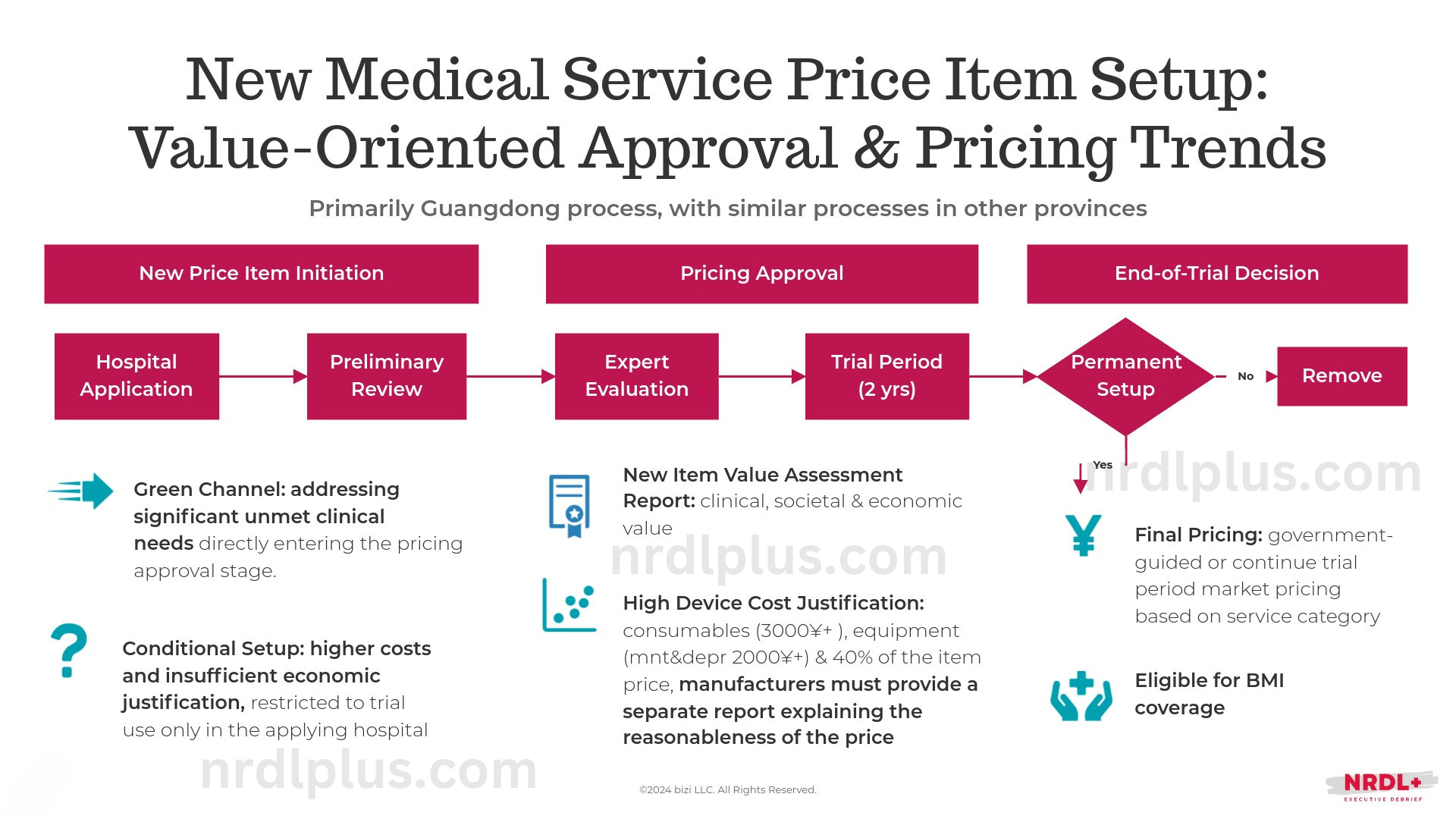

Including medical treatments in a provincial medical service price catalog and assigning prices are prerequisites for not-for-profit hospitals in China to offer and bill for specific treatments.

Although private hospitals are not subject to these regulations and can set their own prices for services outside the catalog, they typically adhere closely to these standards to qualify as BMI-designated institutions and stay competitive.

Thus, for new technologies that address clinical gaps, simplify complex surgeries, or enable novel procedures, establishing a new medical service price item with optimized pricing is crucial for successfully entering China's hospital market.

To better align medical service pricing with innovation, in 2022, NHSA issued the 'Notice on Further Improving the Management of Medical Service Prices.'

This notice highlighted the importance of creating new medical service price items to support medical technology innovation based on clinical value. It urged provincial-level agencies to develop processes to fast-track approval of major innovations that improve treatments for serious diseases or address diagnostic and therapeutic gaps. Additionally, for items with higher cost expectations—primarily due to new equipment or consumables—the notice emphasized the need for thorough evaluations of innovation and cost-effectiveness.

By the end of 2023, nine out of thirty-one provinces in China had explicitly required an innovation report for new medical service price items, with four additional provinces referencing this requirement in policy documents. Ten provinces mandated a health economics evaluation report, and four others included related content in their policies.

As medical service pricing reform advances in China, the momentum behind value-based approval and pricing trends is expected to intensify. To capitalize on these trends, manufacturers should closely track regional policy changes, strategically prioritize entering markets in provinces with high unmet clinical needs and favorable conditions for value-driven pricing, and enhance their evidence-generation and communication capabilities.

Additionally, manufacturers must reassess their organizational roles, capabilities, and alliance partnerships, ensuring they have the right teams with the necessary training and support to navigate the new value-based medical service pricing and approval process.

Trend #3: Centralized Online Procurement for Non-VBP Devices: Balancing Accessibility and Price Control

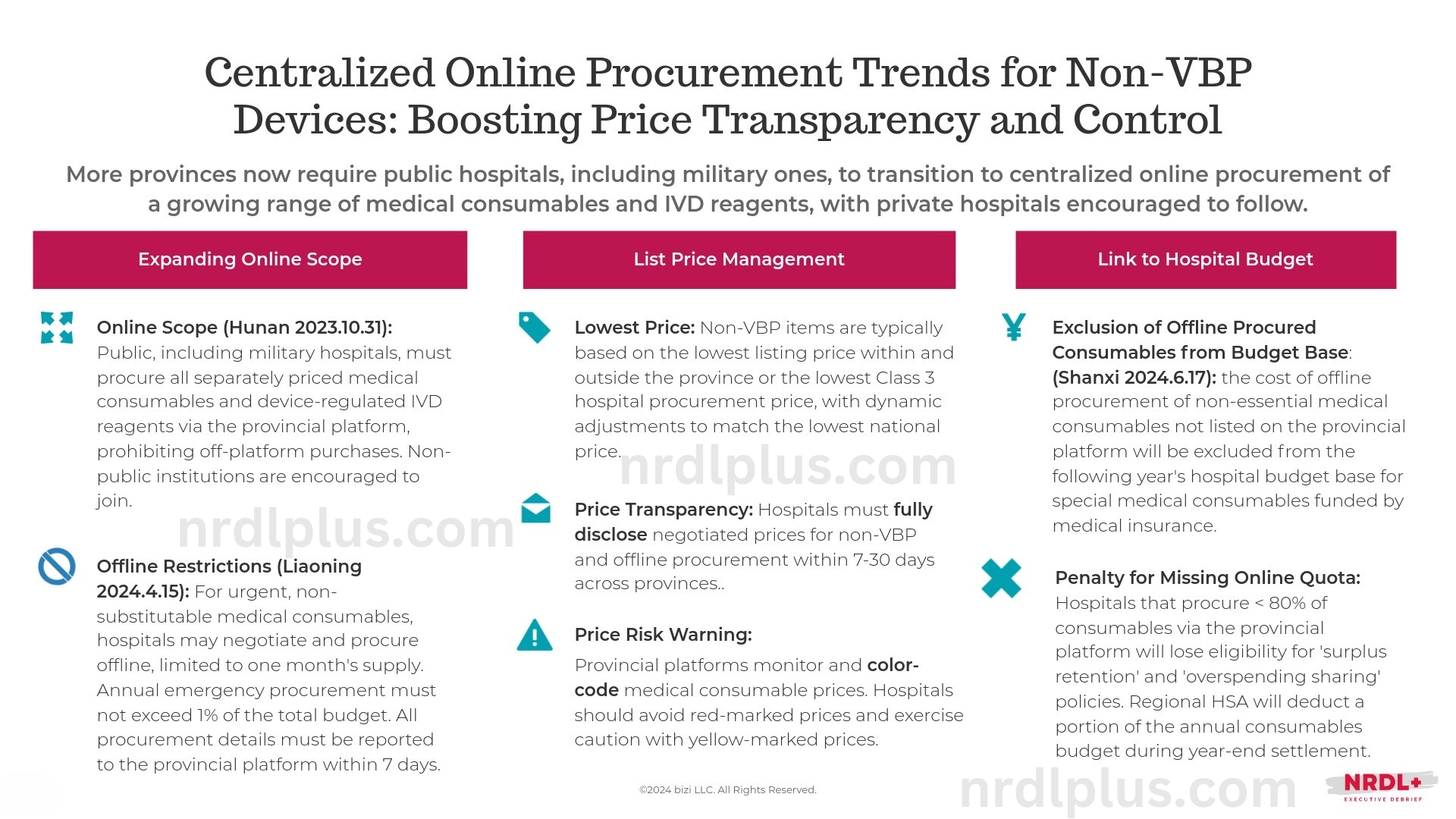

More Chinese provinces require public hospitals, including military hospitals, to shift from offline procurement to centralized online purchasing of an expanding scope of medical consumables and IVD reagents, and private hospitals are encouraged to follow.

Across the board, provinces continue to expand the scope of online procurement, set strict offline procurement limits, and increasingly link meeting the online procurement quota to hospital performance metrics.

Meanwhile, more provinces are also relaxing listing requirements for newly launched innovative medical devices to speed up their time-to-market.

For instance, Jiangsu has eliminated the requirement for procurement records from three provincial tertiary hospitals, an out-of-province listing price, and transaction records. Companies can still list products that don't meet these criteria by committing to the lowest provincial price, provided it remains below the red alert benchmark (similar to how drug list prices are managed). The final listing price for these products will be temporarily undetermined.

Similarly, Liaoning has eliminated hospital processing steps, allowing companies to apply for listing directly anytime and process it within 15 working days. Previously, a secondary or higher-level public hospital had to submit a stamped demand list to apply for retroactive listing. Additionally, manufacturers can now pledge to cap prices at the national lowest for innovative consumables not listed elsewhere in the country.

Whether by lowering listing thresholds, expanding online procurement, or accelerating approvals, price control remains a key focus. Regional price disparities for consumables and reagents are expected to gradually level out. Manufacturers must, therefore, invest in maintaining a consistent pricing system across regions to mitigate the impact of price reductions due to centralized public listing trends for non-VBP innovative products.

At the same time, the shift toward online public listings offers real opportunities for newly launched innovative products to enter broader markets more cost-effectively. As a result, the role of many small and medium-sized distributors will be greatly reduced. Companies should reassess their channel strategies to maximize market access while minimizing costs.

References:

- 医疗服务价格项目创新准入方法和路径, 吕兰婷 et al., 中国人民大学公共管理学院, 2024, 观察与思考

- China's Medical Service Pricing Reform: 3 Core Challenges, NRDL+ Newsletter, 11-8-2023, https://www.nrdlplus.com/chinas-medical-services-pricing-reform-3-core-challenges/

- China's Medical Service Pricing Reform: Current State and Future Development, NRDL+ Newsletter, 11-22-23, https://www.nrdlplus.com/chinas-medical-service-pricing-reform-current-state-and-future-development/

- Xiong W, Deng Y, Yang Y, Zhang Y and Pan J (2021) Assessment of Medical Service Pricing in China’s Healthcare System: Challenges, Constraints, and

Policy Recommendations. Front. Public Health 9:787865.doi: 10.3389/fpubh.2021.787865 - 国家医疗保障局办公室关于进一步做好医疗服务价格管理工作的通知医保办发〔2022〕16号, NHSA, 7-11-2022, https://www.gov.cn/zhengce/zhengceku/2022-07/21/content_5701939.htm

- 易联智慧云2022年全国各省新增医疗服务价格项目流程及分析报告简版

- 《⼴东省医疗保障局新增医疗服务价格项⽬管理办法》2024, Guangdong Healthcare Security Administration, 4-29-2024, https://hsa.gd.gov.cn/zwgk/content/post_4414969.html

- 艾瑞咨询2023年体外诊断IVD行业研究报告

- 关于深入推进医用耗材阳光挂网集中采购的实施意见, Hunan Healthcare Security Administration, 10-31-2023, https://ybj.hunan.gov.cn/ybj/first113541/firstF/f2113606/202310/t20231031_31807358.html

- 医保局发文,耗材挂网规则生变!, 思宇MedTech, 6-1-2024, https://mp.weixin.qq.com/s?__biz=MzIyMTczMzk5OA==&mid=2247605793&idx=3&sn=46291837f1fcd7b520c711d869b5544d&chksm=e9c892a163b4bcba31fb973ff41b12a990df8202aaa989d6d22ca703acdadf8d8f8a8e2bbe5c&scene=27

- 医保局发文,医用耗材集中采购工作再升级, 药智医械数据, 6-19-2024, http://www.phirda.com/artilce_35438.html?cId=4&module=trackingCodeGenerator

- 6月1日起!耗材挂网政策变了,影响大批中小械企, 医疗器械经销商联盟, 4015-2024, https://mp.weixin.qq.com/s?__biz=MzA4MzkzNzYxOQ==&mid=2652926858&idx=1&sn=609ef6256173015bf0599d7dd7ad57e0&chksm=852f0f9e140cc08b8d41e3441004aef42aa94b20ece31174f9727f8954eaf81d9668b1e43a5e&scene=27