Fair Pricing of Pharmaceuticals: Insights into China's NRDL Negotiation

Although NRDL negotiation involves multiple aspects, at its core, the most fundamental issue is the fair pricing of innovative pharmaceuticals.

Unlike developed economies in Europe and the US, where mature healthcare systems primarily hinge on pricing and meeting local conditions for market access, China's healthcare system is in a constant state of evolution. The government actively pursues systemic and linkage reforms to maintain a balance among medical care, medical insurance, and medicine.

Therefore, discussions on drug pricing in China should commence with macro-level indicators reflecting healthcare system priorities, alongside examining specific product-level pricing practices and trends.

China’s Healthcare System Priorities and Innovative Drug Pricing

Allocation of VBP Savings

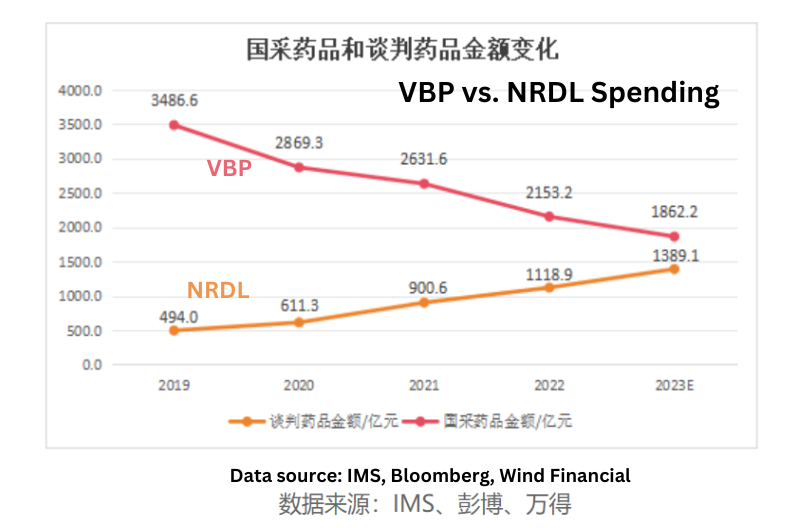

A crucial indicator in this context is how the National Healthcare Security Administration (NHSA) allocates the billions of dollars saved through Volume Based Procurement (VBP) programs.

From 2019 to Q1 2023, VBP for generic drugs resulted in approximately RMB 160 billion in savings. Concurrently, the national negotiation for innovative drugs saw an increase in spending of around RMB 90 billion during the same period. In essence, 60% of the savings from the centralized procurement of generic drugs were directed toward procuring NRDL-negotiated drugs. Back in 2018, patented drugs accounted for less than 10% of the prescription drug market in China.

This shift moves China toward a profile akin to developed markets, where patented drugs, not generics, dominate prescription drug sales. It marks a positive trend for the pricing of innovative medicines in China.

Improving BMI Fund Efficiency

An additional imperative within the healthcare system is the enhancement of BMI fund allocation efficiency.

Over the past decade, the growth of China's basic medical insurance cumulative expenditure has consistently remained at or above 15%. Faced with the prospect of low single-digit GDP growth in the upcoming years, China's BMI fund must maximize its impact on every Yuan.

The NRDL Insurance Funding Analysis Group has recently proposed a new value framework aiming to shift national drug negotiations from bottom-fishing pricing to a fair allocation of medical insurance resources based on drug classification. Innovative drugs that target significant unmet needs and have limited or no alternatives in the BMI catalog will receive priority inclusion and preferential policy support.

In the just concluded 2023 NRDL negotiation, twenty-five class 1 drugs (innovative drugs that have never been marketed anywhere in the world) participated and achieved a higher success rate of 92%, surpassing the average by 7.4 percentage points. These drugs also experienced a lower average price reduction of 4.4 percentage points.

Another opportunity for manufacturers in this context lies in indication expansion for in-catalog products focusing on early prevention and treatment, thereby helping reduce the disease burden for the entire healthcare system.

For instance, within just one year on the Chinese market, abemaciclib, the first NRDL-listed CDK 4/6 inhibitor, has already broadened its indications to include adjuvant treatment for early breast cancer, securing a new place for this expanded indication during this year’s national catalog update.

Product-Level Pricing Practices and Trends

At the product level, drug pricing primarily involves establishing the boundaries of a viable pricing range. From a market perspective, assessing the product's value to customers within the competitive landscape sets the upper limit of this range. Internally, a cost-plus approach, including an evaluation of costs and ROI requirements, establishes the lower limit.

China is seeking a better balance between these limits.

Cost-Plus vs. Value-Based Pricing

As previously discussed, the NHSA is refining its national negotiation strategy, moving from a short-term savings focus to an approach to maximizing fund efficiency and ensuring long-term financial security.

This shift reflects broader trends in China.

Over the years, the NRDL negotiation approach has transitioned from expert-opinion-driven decisions (2010–2017) to evidence-based annual updates (2018–present), aligning closer with international standards.

In a recent press conference, the NHSA emphasized five criteria used in a drug's pharmacoeconomic evaluation to support price negotiations: safety, efficacy, cost-effectiveness, innovation, and fairness. While specific definitions for terms like innovation, fairness, or what qualifies as "cost-effective" are not yet publicly disclosed, they mark a move toward a more sophisticated, evidence-based, and value-driven pricing approach.

More Moderate and Predictable Price Cuts at Contract Renewals

The updated renewal rules play a crucial role in defining expectations for price adjustments during the lifecycle of NRDL-negotiated drugs, aligning with the NHSA's proposed framework for synchronized pricing management.

In the latest renewal cycle, 70% of the 100 drugs maintained their original prices, showcasing stability. Only 31 drugs experienced a modest 6.7% average price reduction, mainly due to exceeding sales expectations. Among the 100 drugs, 18 introduced new indications, leading to a price reduction in one case.

Moreover, the updated rules allow drug manufacturers to negotiate a lower price reduction than the simplified renewal reduction, departing from the previous requirement of equal or higher reductions during renegotiation.

Price-Volume Trade-Off and Cost Ceilings Remain.

The ongoing theme for China's national negotiations in the coming years will revolve around the trade-off between price and volume, favoring innovative medicines designed for large patient populations and severe diseases.

According to McKinsey, 90% of the top 20-selling MNC brands in China are included in the NRDL, with 50% focusing on cancer and 30% on chronic diseases such as metabolism, cardiovascular issues, and immunology. Innovative vaccines, funded through a separate public health package, are not included in this list.

It's worth noting that these successful brands in China differ significantly from the global trend, where MNCs' top-selling products increasingly target small patient populations.

Looking at product-level budget impact, a consistent annual cost limit of 500,000 RMB serves as the threshold for a drug to enter NRDL negotiations, with a further limit of 300,000 RMB for successfully negotiated drugs. Currently, there is no distinction in annual cost limits for high-value innovative therapies.

As a result, two CAR-T products did not enter negotiations this year, and none of the four ADC products, including AZ's DS-8201, with an annual cost ranging from 300,000 to 500,000 RMB, successfully completed the final negotiation process.

Final Thoughts

Undoubtedly, the NRDL has proven to be an effective gateway for innovative medicines designed to treat severe diseases within expansive patient populations.

As adjustments are made to enhance fund efficiency, China's national negotiation is transitioning from a short-term emphasis on savings to a strategic procurement framework grounded in value assessment. This presents opportunities for authentic, innovative medicines to address substantial unmet needs, particularly those focusing on prevention and early treatment.

However, in the face of the prospect of low single-digit GDP growth, cost containment will persist as the central theme in China's NRDL negotiations.

The steadfast commitment to the "insuring basic" principle also leaves a considerable gap, necessitating the exploration of alternative financing mechanisms to enhance the affordability of high-value medicines, particularly those targeting smaller patient populations.

References:

- “腾笼换鸟”趋势明显——五年集采、谈判现新局, 中国医疗保险 2023-12-1, http://www.phirda.com/artilce_33461.html?cId=4

- 创新药医保支付,挺进深水区, 深蓝观 12-15-23, http://www.phirda.com/artilce_33627.html?cId=1

- 国家医保局2023年国家基本医疗保险、工伤保险和生育保险药品目录调整新闻发布会实录, NHSA, 2023-12-13, https://mp.weixin.qq.com/s/EetwVP85h3pITzD5VFjG8w

- McKinsey, China Biopharma - Charting a path to value creation, Nov. 2023

- 2023医保谈判落地:ADC未进医保,PD-1市场格局或大变, 深蓝观 2023-12-13, https://mp.weixin.qq.com/s/3zpc1G1ae4k5g7ge2CtkAw