China's Basic Medical Insurance Data: Three Key Trends and Ecosystem Implications

The 2022 National Medical Security Industry Development Statistical Bulletin, along with the Basic Medical Insurance operation data for Q1 to Q3 2023 released by the National Healthcare Security Administration (NHSA), reveals three key trends. Grasping these trends is vital for appreciating the direction of healthcare reform in China and its implications for stakeholders within the ecosystem.

Trend #1 The aging population exerts pressure on the income and expenses of basic medical insurance.

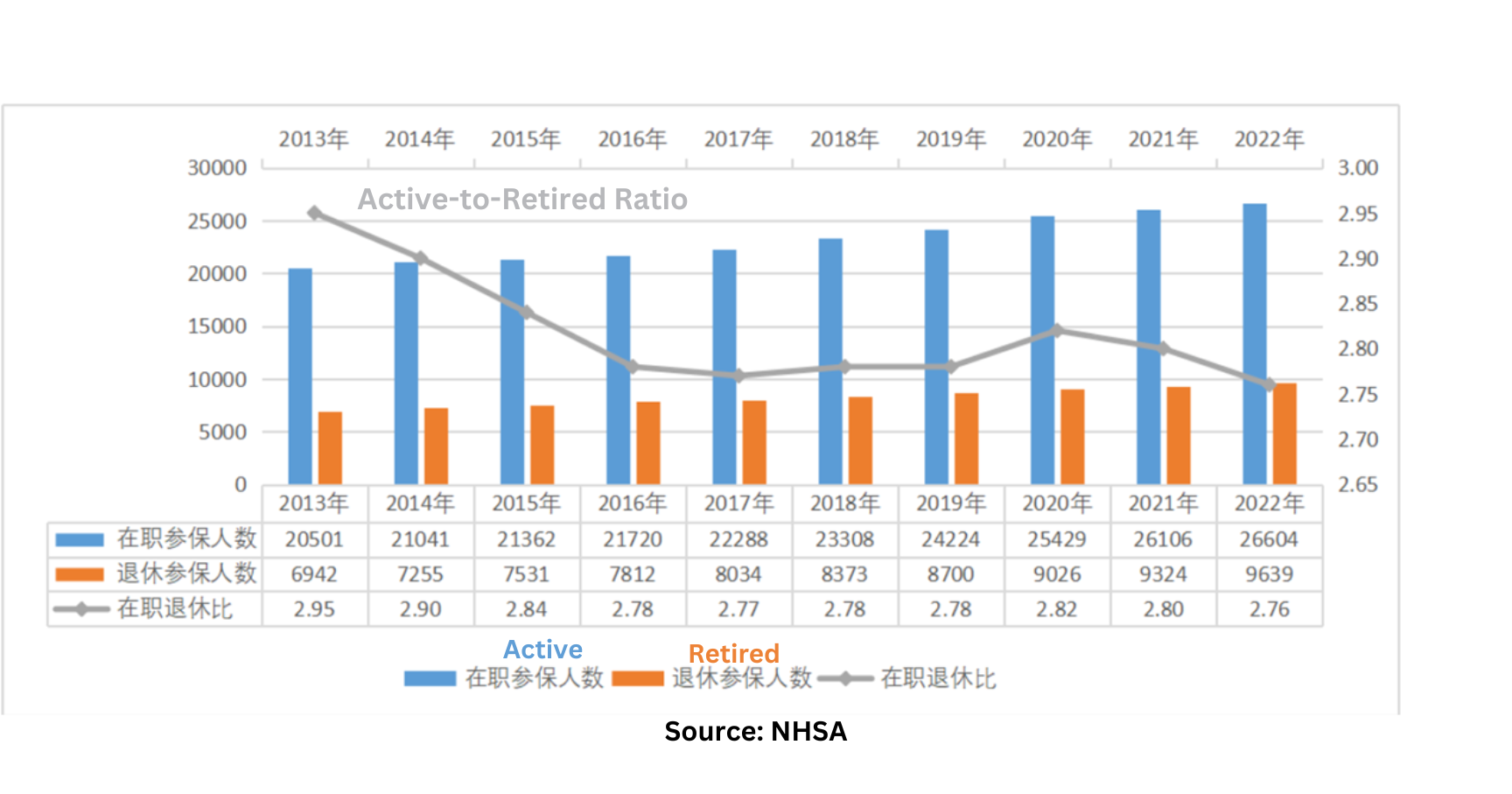

Fig 1 Structure of Urban Employee Medical Insurance Enrollees from 2013 to 2022 (unit: ten thousand people)

- In 2022, urban employee medical insurance enrollment hit 362 million, with a 2.3% year-on-year growth rate, further slowing from 3% in 2021 and 4.6% in 2020.

- Among these, active employees were up 1.9%, while retired employees showed a 3.4% increase from the previous year.

- Meanwhile, resident medical insurance participation has continuously declined for three years since its peak in 2019.

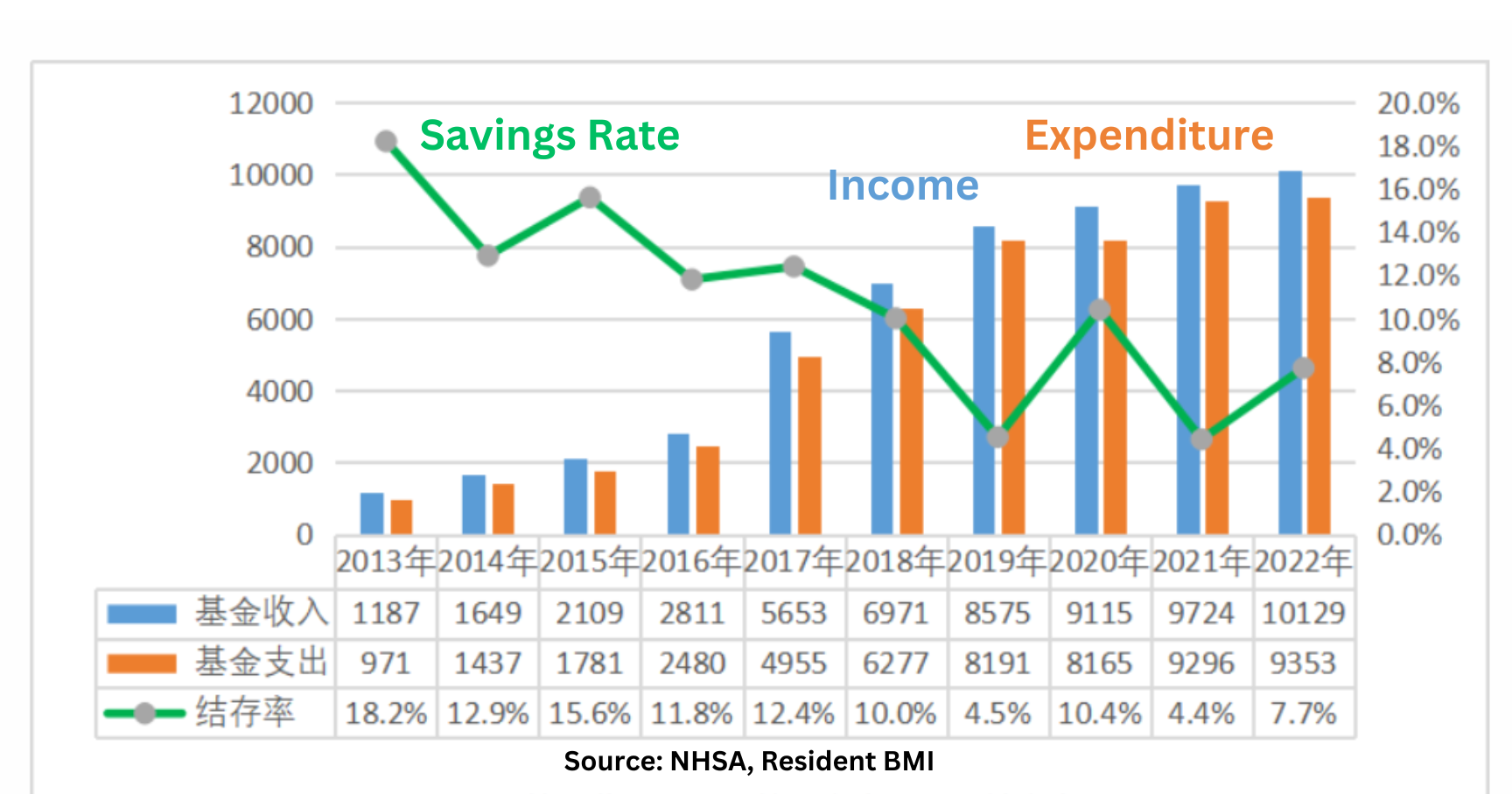

- In 2022, urban employee medical insurance funds, including maternity insurance, saw an income of 2.0793 trillion yuan, up 9.4% from the previous year. Expenditure totaled 1.5243 trillion yuan, a 3.3% increase over the previous year.

- This marks the first time in the past decade that the urban employee medical insurance funds revenue growth fell into single digits (excluding 2020, which saw a reduction due to COVID-induced payroll tax adjustments).

- As for resident basic medical insurance funds, expenditure growth outpaced income growth for eight years over the ten years from 2012 to 2021, suggesting a more acute cost control challenge compared to urban employee medical insurance.

- From January to September 2023, as a whole, the basic medical insurance funds grew by 9.2% year-on-year, with total expenditures increasing by 17.9% year-on-year. The fund balance is decreasing.

Fig 2 Income and expenditure of resident medical insurance funds from 2013 to 2022 (unit: 100 million yuan)

Trend #2 The growth rate of outpatient care for chronic diseases far exceeds that of general outpatient services due to the shift in the disease spectrum.

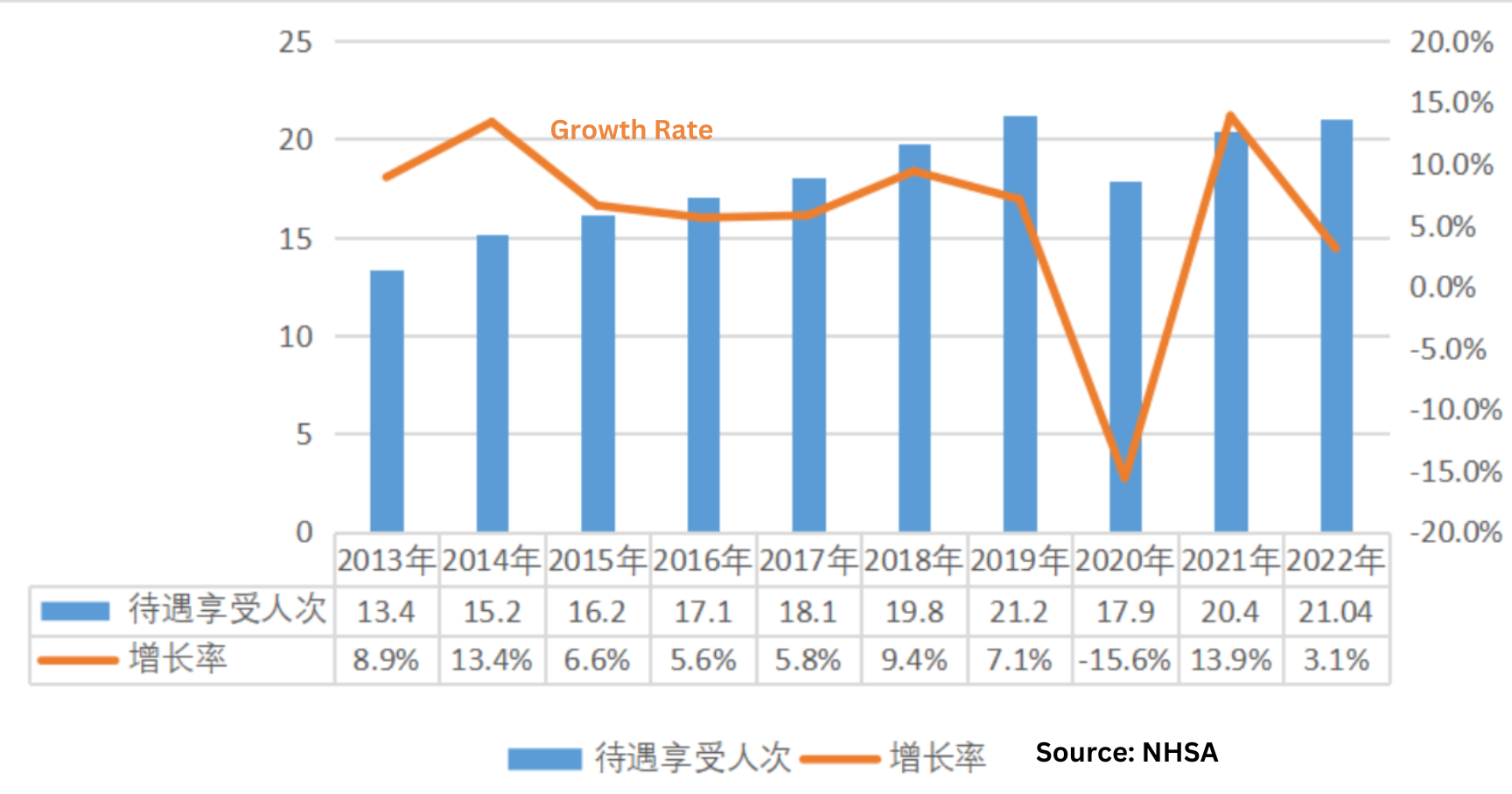

Fig 3 Count of Beneficiaries Under Urban Employee Medical Insurance from 2013 to 2022 (Unit: 100 Million Instances)

- In 2022, urban employee medical insurance saw 1.76 billion regular outpatient and emergency visits, marking a 2.3% increase compared to the previous year, typically ranging between 5-9% since 2013.

- Additionally, there were 280 million outpatient visits for chronic and special diseases, representing an 8.3% increase from the previous year, typically in double digits since 2013.

- In terms of beneficiary ratios, under urban medical insurance, chronic care users increased from 9% to 13% from 2013 to 2022, as the general outpatients' share dropped from 88% to 84%.

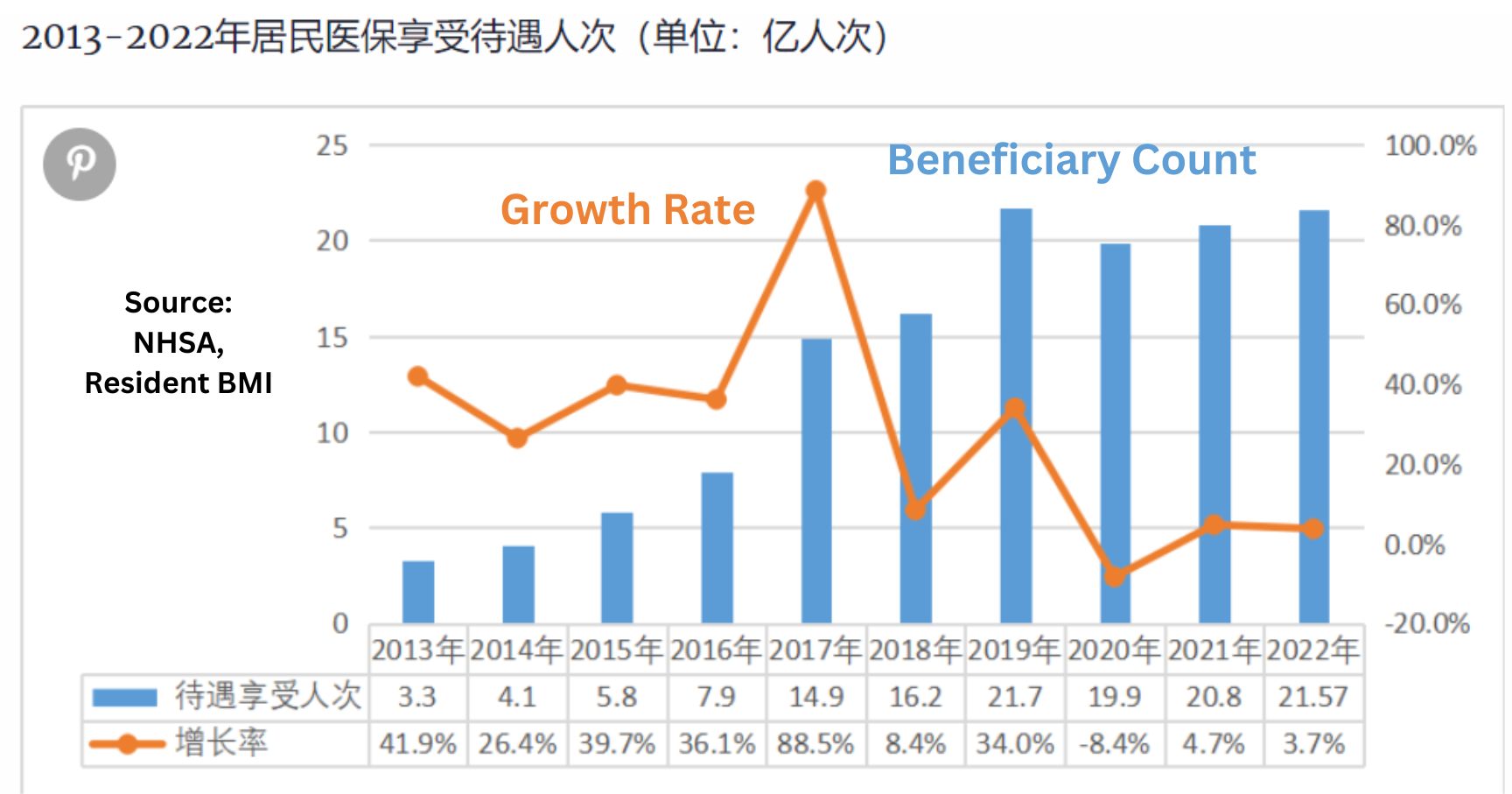

- Resident medical insurance saw 1.7 billion regular outpatient and emergency visits in 2022 (up 1%), alongside 297 million outpatient visits for chronic and special diseases (up 21.7%). Since 2017, the latter has typically grown 2-6 times faster than regular outpatient visits.

- Beneficiary shares shifted under resident medical insurance, with chronic care rising from 4% in 2013 to 14% in 2022, as general outpatient contributions fell from 89% to 79%.

Fig 4 Count of Beneficiaries Under Resident Medical Insurance from 2013 to 2022 (Unit: 100 Million Instances)

Trend #3 The hospitalization rate and cost remain high.

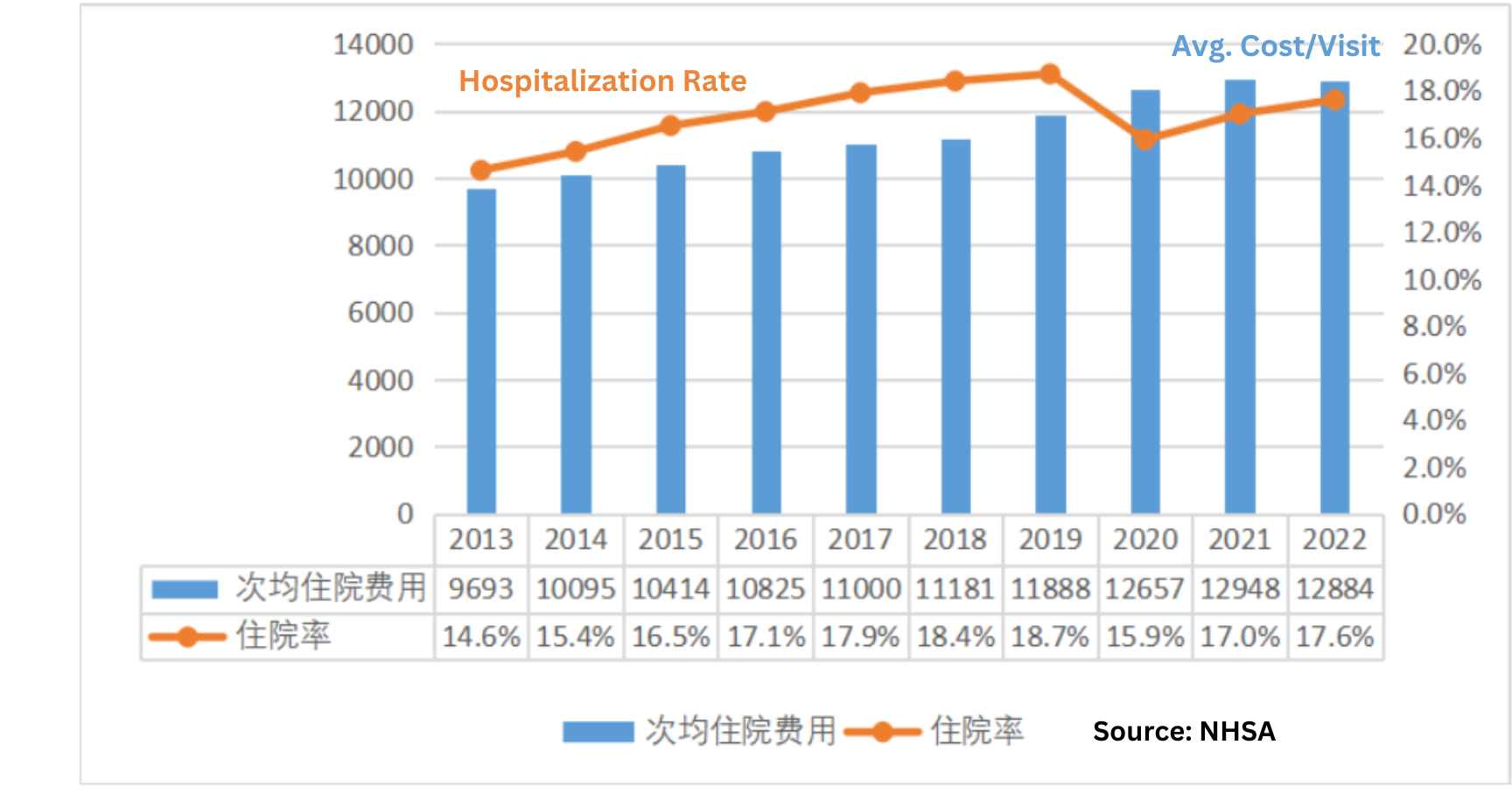

Fig 5: Average Hospitalization Expenses per Visit for Urban Employee Medical Insurance, 2013-2022 (Unit: Yuan)

- China faces a persistent challenge with high hospitalization rates among urban employee medical insurance retirees, a problem compounded by the incoming retirement wave.

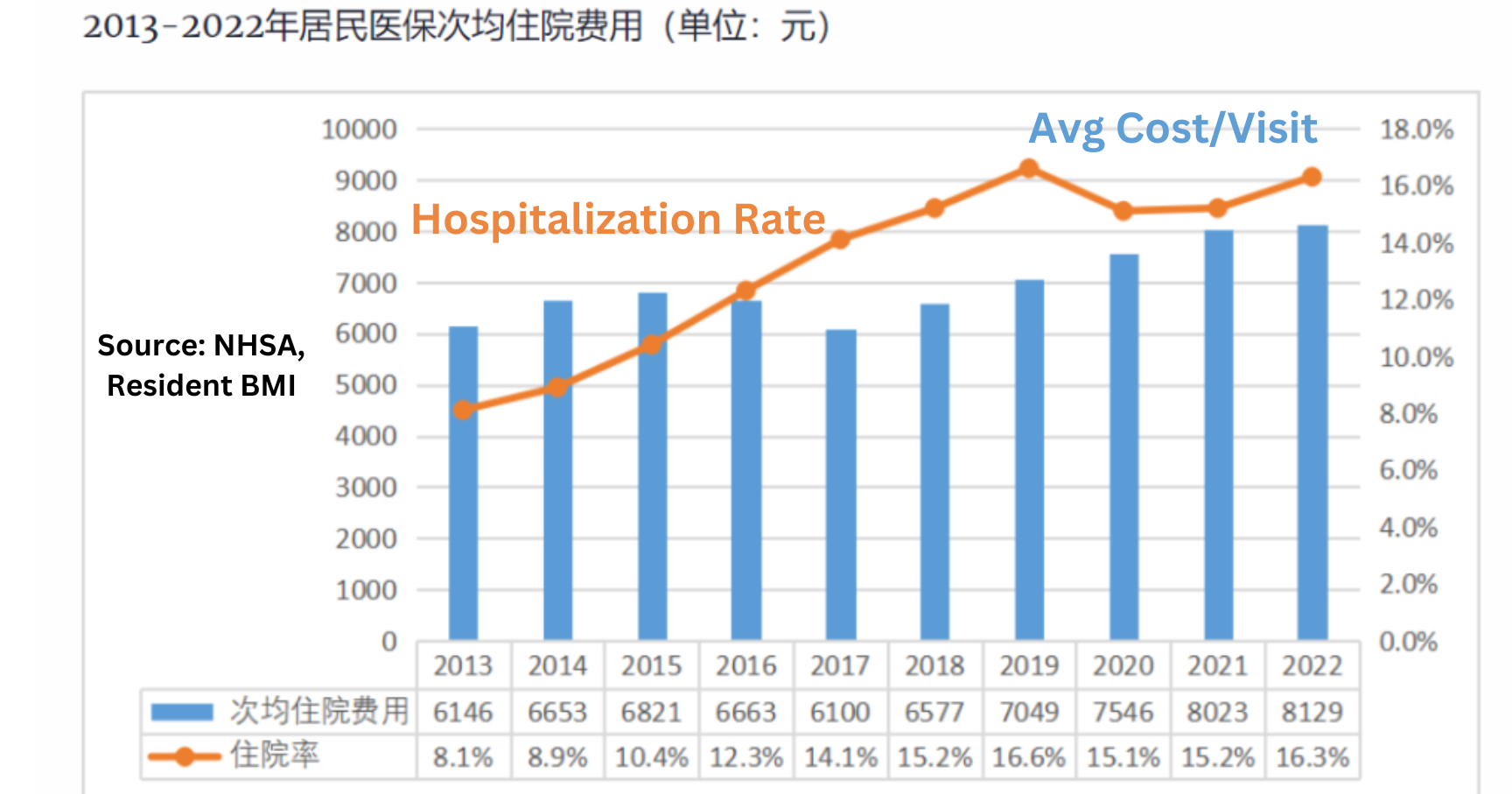

- From 2013 to 2022, the hospitalization rate for urban employees rose from 14.6% to 17.6%, and hospitalizations represented 59% of employee medical expenses in 2021. The rate for resident medical insurance surged even faster, from 8.1% in 2013 to 16.3% in 2022, nearing the 2019 peak of 16.6%.

- Rising alongside the high hospitalization rates are escalating costs. From 2013 to 2022, the average hospitalization cost under urban employee medical insurance grew from 9,693 yuan to 12,884 yuan, and for resident medical insurance, it increased from 6,146 yuan to 8,129 yuan.

- In 2022, under urban employee and resident medical insurance, the average hospital stay shortened to 9.5 and 9.2 days, down by 0.5 and 0.2 days from the previous year, respectively.

- Over the last decade, the national average hospital stay has reduced to 9.2 days, primarily due to reductions in public hospitals from 10.7 days in 2010 to 9.0 days in 2021, showing the effects of payment reform. Conversely, the average stay in private hospitals rose from 8.4 days in 2010 to 10.5 days in 2021.

Fig 6 Average Hospitalization Expenses per Visit for Resident Medical Insurance, 2013 to 2022 (unit: yuan)

Ecosystem Implications

The collective challenges emphasize the importance of improving BMI fund efficiency amid China's slowing GDP growth. They also indicate a growing necessity for new policies aimed at tackling the rise in outpatient care for chronic diseases and the sustained high rates of hospitalization.

These conditions present a pivotal opportunity for authentic payment innovation rooted in medical risk management within the commercial health insurance sector, particularly concerning high-cost outpatient specialty drugs treating chronic diseases.

Additionally, they will create more room within the basic medical insurance to reward genuine medical innovation that alleviates healthcare system burdens by preventing hospitalizations, shortening stays, or emphasizing disease prevention and early treatment.

In the provider sector, payment reform will broaden from DRG/DIP models for short to medium-term hospital stays to daily rates for long-term inpatient care and capitation for outpatient services.

References:

- 2022年全国医疗保障事业发展统计公报, NHSA, 7-12-2023, http://www.phirda.com/artilce_32032.html?cId=1

- 医保数据呈现的五大趋势, LatitudeHealth, 7-13-2023, http://www.phirda.com/artilce_32041.html?cId=1

- 2023年1-9月基本医疗保险和生育保险运行情况, NHSA, 10-25-2023, http://www.nhsa.gov.cn/art/2023/10/25/art_7_11440.html

- 郑杰:医保支付改革进展与展望, Peking University School of Continuing Medical Education, 2023-7-5, https://scme.bjmu.edu.cn/jchg/a70124b79603439483fda71a89a25c8a.htm