Capitalizing on Specialized Medical Services in China: Opportunities for Innovative Life Sciences Manufacturers

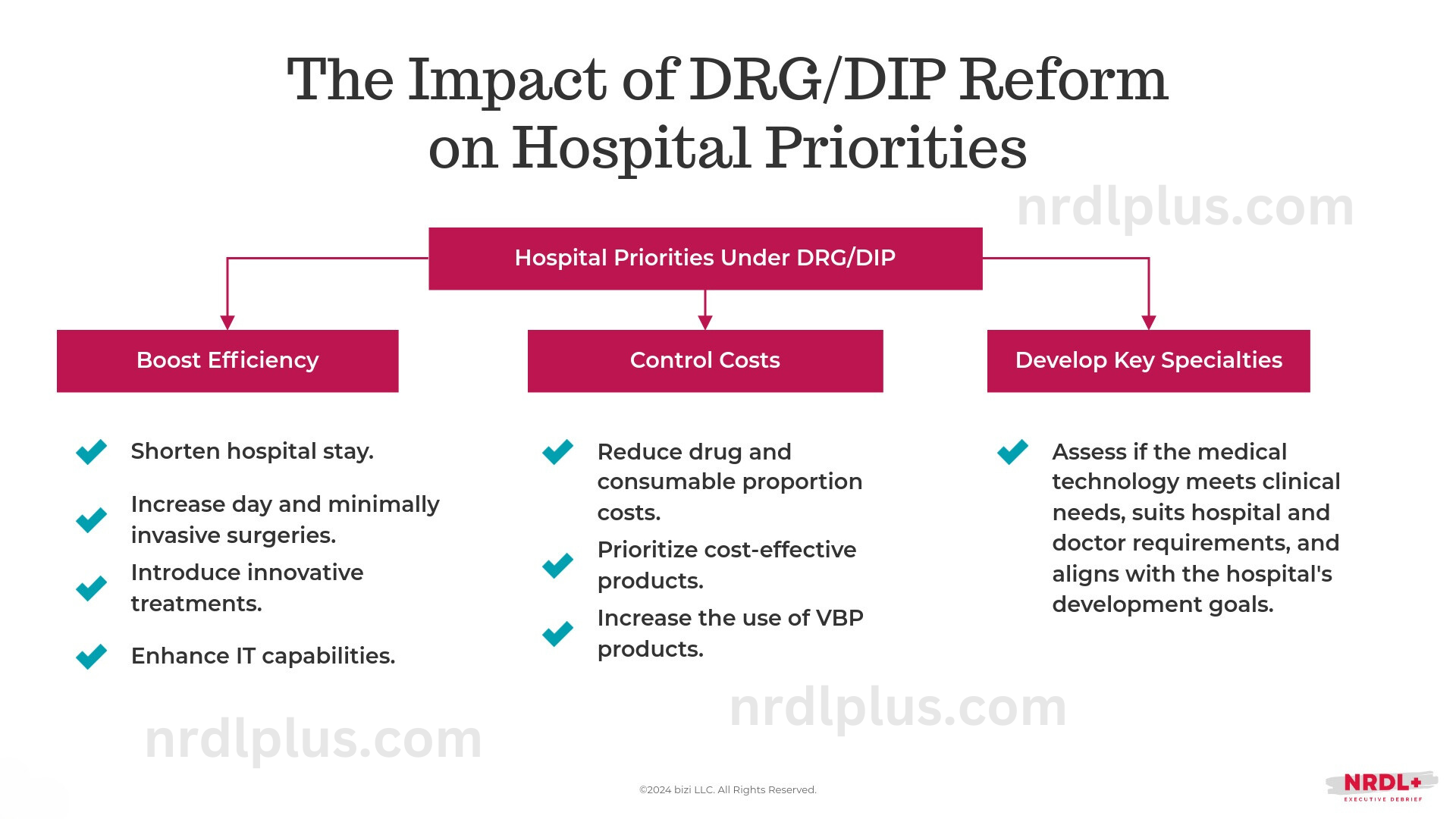

Specialized medical services (特需医疗服务) have become essential for Chinese public hospitals to sustain financial stability as revenue from drugs, consumables, and government subsidies declines, and financial risks are increasingly shifted to providers under the DRG and DIP payment models.

Although public hospitals are limited to offering no more than 10% of their services as self-priced specialized care, many continue to focus on basic services, with most staying well below this threshold. For instance, a leading hospital in Yangzhou reported that specialized services made up only 3.8% of its total in 2021, highlighting substantial growth potential for these services in Chinese public hospitals.

This creates a significant opportunity for innovative technology companies that cater to personalized and differentiated healthcare needs.

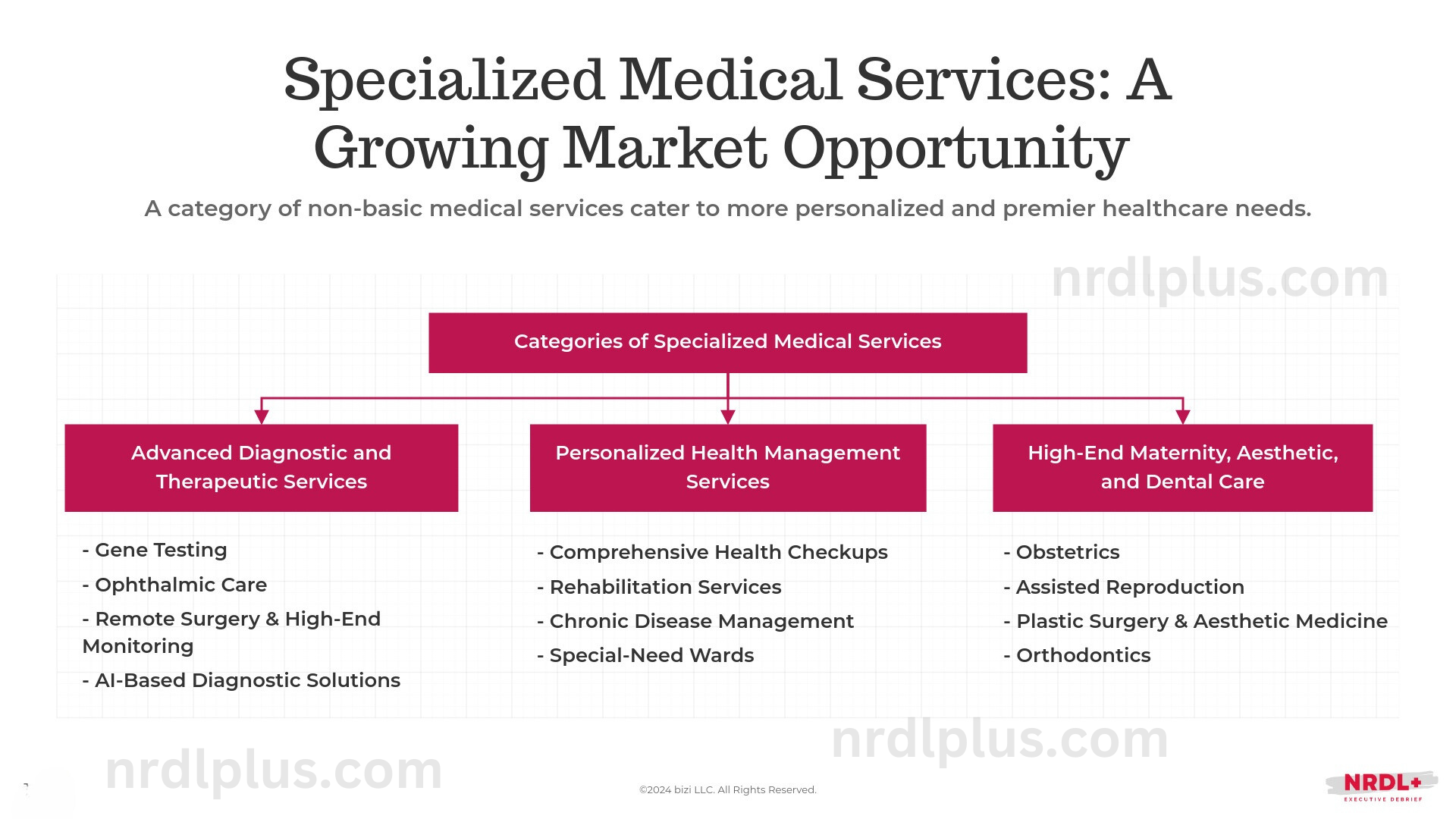

What are Specialized Medical Services?

Specialized medical services are a category of non-basic medical services designed to meet the specific needs of patients seeking more personalized or premium healthcare. These services often include higher registration fees, specialized consultations, and access to cutting-edge medical technologies or treatments not yet covered by basic health insurance. They bridge the gap between basic public healthcare and the increasing demand for diverse, high-quality medical services.

Hospitals are encouraged to adopt advanced technologies like remote surgery equipment, AI-driven diagnostic tools, and high-end health monitoring systems to develop new, tech-enabled specialized services. These innovations can significantly enhance diagnostic and treatment efficiency while making premium healthcare services more accessible.

Advanced Diagnostic and Therapeutic Services:

- Gene Testing: Personalized genetic tests for preventive healthcare or diagnosing genetic disorders.

- Ophthalmology: Specialized eye care, including advanced surgeries and tailored treatment plans.

- Remote Surgery & High-End Monitoring: Advanced systems to perform surgeries remotely and monitor patients’ health in real-time.

- AI-Based Diagnostic Solutions: Leveraging AI to improve diagnostic accuracy and treatment outcomes.

Personalized Health Management:

- Comprehensive Health Checkups: Premium preventive screening packages that offer more advanced tests than standard checkups.

- Rehabilitation Services: Tailored rehabilitation programs using advanced equipment and personalized care plans.

- Special-Need Wards: Dedicated wards for patients requiring specialized care.

- Chronic Disease Management: An area poised for future expansion.

High-End Maternity, Aesthetic, and Dental Care:

- Obstetrics: Premium maternity care services, from specialized prenatal services to delivery and postpartum care.

- Assisted Reproduction: Fertility treatments and advanced assisted reproductive technologies, like IVF.

- Plastic Surgery & Aesthetic Medicine: Cosmetic procedures, including facial plastic surgery, body contouring, and skin treatments.

- Orthodontics: Specialized dental care focused on correcting teeth alignment and jaw issues.

How are Specialized Medical Services Managed Across Provinces?

Management practices for specialized medical services differ across provinces, but they typically involve the following key elements:

Application and Hospital Qualification: In most provinces, only secondary or higher-level hospitals with independent legal status are eligible to offer specialized services. These services must be provided in designated areas with dedicated medical staff and infrastructure. Hospitals are required to submit their plans, including the establishment of new service price items, for approval by local health and medical insurance authorities before launching any new specialized offerings.

Service Cap: Most provinces limit specialized services to 10% of a hospital’s total services. In some regions, like Guangdong and Hainan, stricter regulations control the number of services, hospital beds, and revenue from these services, ensuring that they do not surpass 10% of total medical income. Additionally, some provinces mandate hospitals to maintain separate financial accounts to track specialized services.

Price Setting: Pricing for specialized services follows market-driven rates based on costs and local market conditions. Some provinces publish standardized price catalogs to maintain consistency across services. While hospitals may have some flexibility in setting prices, they are often required to disclose and file these prices to ensure pricing remains fair and transparent.

Three Key Success Factors for Innovative Medicine Makers to Capitalize on Specialized Medical Service Growth

a. Align with Regional Characteristics and Hospital Specialties

Since specialized medical services are designed to meet personalized healthcare needs, they are closely tied to local market dynamics.

Additionally, following the implementation of DRG, hospitals are highly motivated to improve operational efficiency by focusing on their specialized areas and enhancing cost management. Large hospitals, in particular, are becoming more focused on strengthening their core specialties.

Therefore, manufacturers should target markets where their products align well with local demands and assess how their offerings fit within the hospital's core development goals to maximize market penetration.

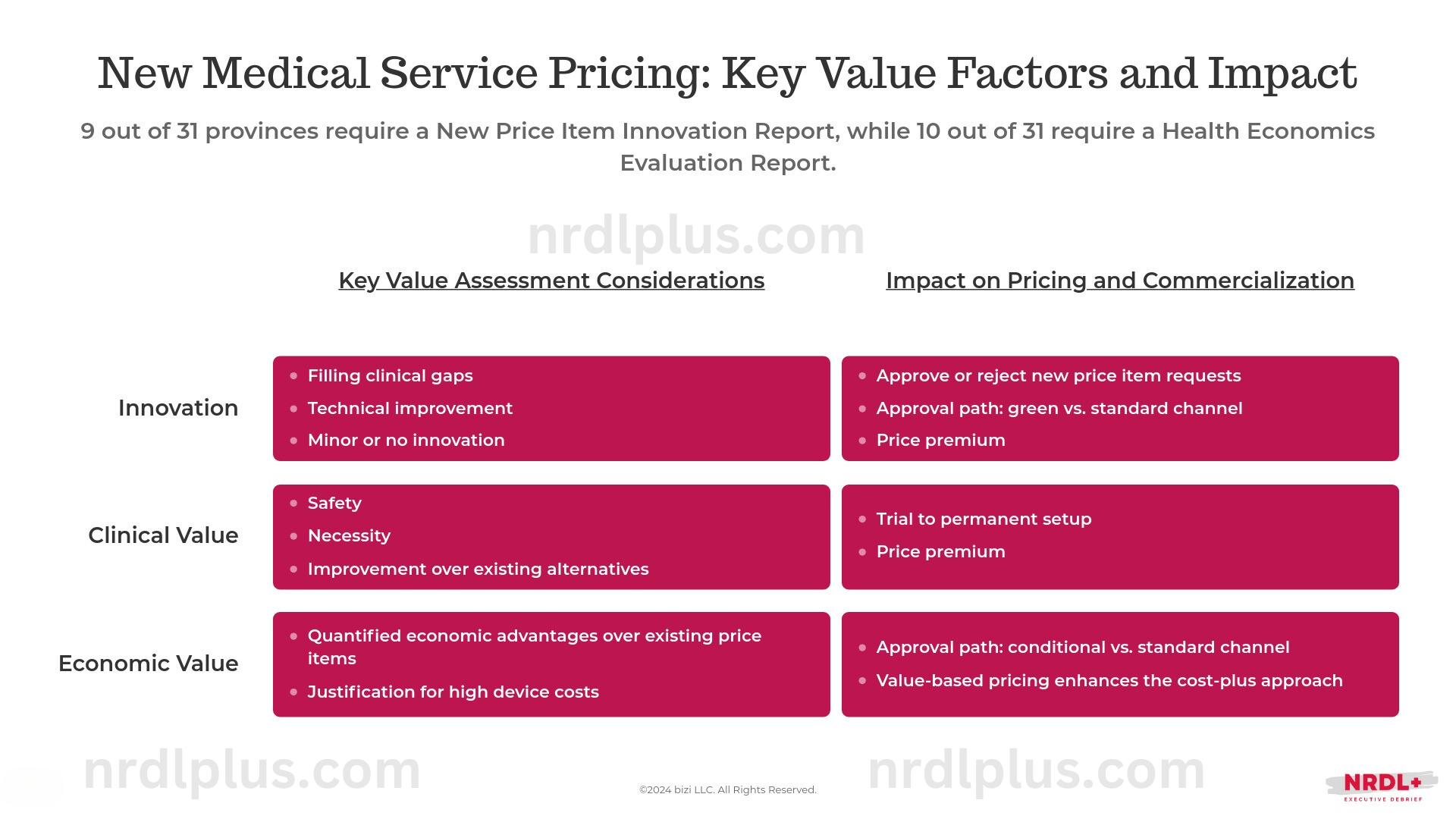

b. Leverage Value-Based Approval and Pricing Trends for New Medical Services

Pricing specialized medical services has long been a challenge for public hospitals. Regional variations in approval processes and unclear guidelines on what qualifies as "specialized" or how to set prices have slowed the adoption of new technologies.

In response, the NHSA issued the "Notice on Further Improving the Management of Medical Service Prices" in 2022, calling for new price items that support technological innovation, especially those with strong clinical value, including specialized medical services. Additionally, for high-cost items, such as those involving new equipment or consumables, the notice also emphasized thorough evaluations of both innovation and cost-effectiveness.

By the end of 2023, 9 out of 31 provinces require a New Price Item Innovation Report, while 10 out of 31 require a Health Economics Evaluation Report.

Therefore, to ensure their technologies are successfully adopted, manufacturers should actively track local policy shifts and adjust their pricing and evidence-generation strategies accordingly to align with regional developments.

In doing so, it’s also crucial to understand what hospital decision-makers value in specialized medical services. A recent survey of BMI and public hospital decision-makers revealed different priorities for high-value medical consumables: BMI decision-makers focus on cost-effectiveness and long-term efficacy for insurance access, while hospital decision-makers emphasize safety and short-term efficacy during the hospital listing process. While this survey focused on consumables, similar value considerations likely apply across various medical technologies. Understanding these differing perspectives is key to aligning firms’ strategies with both groups.

c. Engage Commercial Health Insurance to Expand Market Uptake

The payment for specialized medical services under basic medical insurance depends on the price-setting mechanisms in place, with some regions like Guangdong only covering basic medical services while excluding market-regulated prices. Even when basic medical insurance offers partial coverage, patients often bear the additional cost of premium services, resulting in a high out-of-pocket burden.

This challenge is also evident in the Guangdong-Hong Kong-Macao Greater Bay Medicine Connect Program, where patients face high out-of-pocket costs because Hong Kong or Macau-approved medical technologies are not integrated into the mainland insurance system, limiting access, especially for low-income groups.

In this context, commercial health insurance is becoming increasingly vital in covering market-priced medical services, particularly specialized services not covered by basic medical insurance. Innovative technology developers should partner with commercial insurers to ensure their products are included in insurance catalogs. The success of these efforts depends on the actual payment capacity of commercial insurers, with an initial focus on addressing the most accessible opportunities.

References:

- 郑大喜. 公立医院特需医疗服务项目价格管理政策回顾、方案比较与启示[J]. 中国卫生经济,2024,43(1):44-48.

- 贺书瑾,龙海霞,黄玥. 基于史密斯模型的"港澳药械通"政策有效执行影响因素研究[J]. 卫生软科学,2024,38(4):45-47,51. DOI:10.3969/j.issn.1003-2800.2024.04.010.

- 姚瑶,栾伟,崔宇杰. 需求侧视角下三级公立医院非基本医疗服务分析[J]. 中国卫生经济,2023,42(3):67-71.

- 邵旸,蔡滨,樊美琪,等. 新发展理念下公立医院开展特需医疗服务的路径探讨[J]. 江苏卫生事业管理,2023,34(1):88-92. DOI:10.3969/j.issn.1005-7803.2023.01.025.

- Three Key Trends Shaping Pricing for Innovative Non-VBP Medical Devices in China, NRDL+ Newsletter 8/28/24, https://www.nrdlplus.com/three-key-trends-shaping-pricing-for-innovative-non-vbp-medical-devices-in-china/

- 高值医用耗材价值评估和实践应用研究报告, BD, 2023

- Pricing and Payment Optimizing Strategies for New Medical Technologies in China, Wang Haiyan et al., Chinese Health Quality Management, 2020, 27(1):105-108

- Fostering Medical Innovation: How China's Social and Commercial Insurance Can Work Together, NRDL+ Newsletter, 5/29/24, https://www.nrdlplus.com/fostering-medical-innovation-how-chinas-social-and-commercial-insurance-can-work-together/