Access Pathway for Innovative Medicines in China: Pure Commercial Health Insurance

In the last installment, we introduced City Commercial Health Insurance (City CHI), a type of all-inclusive commercial health insurance positioned between basic social medical insurance (BMI) and pure commercial health insurance (CHI) featuring strong public-private partnerships. In this article, we will focus on pure commercial health insurance.

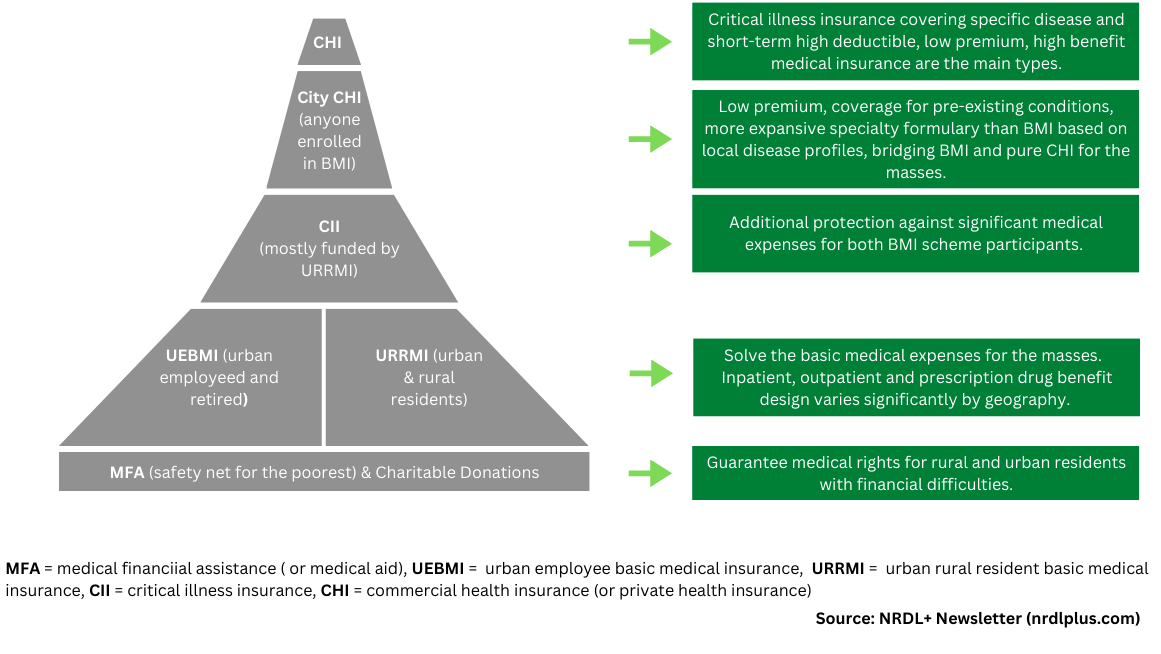

Figure 1: China’s Multi-Layered Health Financing Ecosystem

Current State of China’s Pure Commercial Health Insurance Market

Health insurance is a latecomer compared to the life and property insurance sectors in China's commercial insurance market. However, it has experienced rapid growth since the start of China’s healthcare reform in 2009. Growing at an annual compound rate of 26%, the CHI sector has reached 982.5 billion yuan (US $151 billion) in premium income in 2021, accounting for 22% of the total commercial insurance market, up from 5.5% in 2009. It is forecasted to reach over 2 trillion yuan (US $308 billion) by 2025.

China’s political climate, economic development, and fundamental shifts in population demographics and disease patterns are key drivers behind the phenomenal growth of the commercial health insurance market.

- A supportive policy environment. Government policies support the development of commercial health insurance to ease the burden on basic social medical insurance

- A fast-developing middle class increasingly demands more customized healthcare experiences than what the basic social medical insurance can accommodate

- Shifting disease pattern to chronic diseases, particularly the high incidence rate of cancer

- Aging population

The pure commercial health insurance segment currently offers three main types of products. Their adoption directly and positively correlates with consumers’ income and education level.

• Personal critical illness insurance (CII) for specific diseases. This is not to be confused with the provincial critical illness insurance introduced under the basic social medical insurance pathway.

Personal CII is a fixed-benefit product often sold as a rider on savings plans or life and accident insurance products by life insurance and property insurance companies. It provides one-off lump sum payments when a critical illness is diagnosed.

Currently, critical illness insurance covers more than 120 disease types, with particular attention paid to malignant tumors and cardiovascular diseases. In addition, most plans exclude pre-existing conditions.

• High-end long-term medical insurance. Insurance companies and high-end medical service providers in China offer this type of insurance. They are similar to health insurance in the US and reimburse policyholders based on actual medical and drug expenditures, hence offering greater financial protection than lump sum payments.

These plans also feature their own provider network, thus, can integrate financial protection with access to care, a feature China’s middle-class consumers increasingly demand in health insurance products.

• Mid to low-end short-term medical insurance. In addition to traditional life and property insurance companies, China's internet giants have also entered the short-term medical insurance field with a series of innovative products.

The most popular is “million medical.” These plans feature low premiums yet a high insured amount of up to one million yuan against large medical expenses. They also offer personalized coverage for pre-existing conditions, specialty drug formularies, optimized claim experiences, and value-added services.

But unlike high-end medical insurance and critical illness insurance, the majority are one-year products with no guarantee of renewal.

Among these products, personal critical illness insurance accounts for the largest segment of the overall CHI market (inclusive of City CHI) in premium income, with 47% in 2020. The product’s popularity stems from strong consumer demand for long-term protection against large out-of-pocket expenses for critical illnesses not covered under the BMI.

For insurers, personal CII products have been the most significant contributor to their long-term cash flows and profits, as consumers are willing to pay more for long-term protection against serious illnesses.

Emerging Trend: From Fixed-Benefit Financial Protection to Comprehensive Health Risk Management

However, since 2019, personal critical illness insurance growth has slowed.

First, constrained by their legacy operating environment, traditional life and property insurance companies in China lack access to quality data, thus, have been unable to develop differentiated health insurance products, which leads to price-based competition eating into insurers’ profit margins.

Second, as Chinese consumers become more sophisticated about protecting against health risks, consumption-type medical insurance like City CHIs, “million medical,” and long-term medical insurance started showing replacement effects for fixed-benefit personal critical illness insurance offerings.

Not surprisingly, under pressure, personal CII products have been adapting in recent years, including introducing specialty drug insurance that provides not only reimbursement but also related value-added specialty drug services for policyholders.

The shift from traditional fixed-benefit insurance products to consumption type of commercial health insurance that integrates financial protection with access to care signals that China’s commercial health insurance market is moving up the value chain.

Industry insiders broadly concur that the sector will further diversify. We will see the emergence of more pure-play commercial health insurance organizations, enabled by data and technology, with specialized expertise in CHI product design, underwriting, claims and reimbursement processing, and health services management.

Opportunities Abound for Key Stakeholders

Strong partnerships between stakeholders, i.e., commercial insurers, pharmacy benefit managers, and innovative drug and device manufacturers, are essential to achieve such a transformation.

For manufacturers, commercial success hinges on product access. Product access hinges on affordability. The limitation of China’s basic social medical insurance and the significantly enhanced commercial health insurance market reach means CHI is no longer just a pre-NRDL consideration in China. All manufacturers must have a multi-layered access strategy throughout the product life cycle.

For China’s commercial health insurers, City CHI has brought the industry out of the “lonely island” in two significant fashions:

- It has introduced the concept of commercial health insurance into mainstream Chinese families and,

- equally important, it has allowed commercial insurers to accumulate critical data, especially data on patients with pre-existing conditions, to support future product innovation.

Yet, the all-inclusive nature of City CHI has determined its limited profit potential for insurers. As a result, commercial insurers must improve their customers' lifetime value to balance market reach with profitability through follow-on offerings aimed at coverage gaps under BMI and City CHI.

One of the most significant opportunities in this regard is to unleash the power of commercial health insurance in financing access to high-value innovative therapies.

Lastly, China’s pharmacy benefit managers (PBMs), also called Third-Party Administrators (TPAs), sit between commercial insurers and manufacturers. As a key player in China’s healthcare ecosystem, PBMs have actively participated in City CHI and high-end CHI product design and offered related health management services. Effective collaboration with PBMs will be critical for manufacturers to efficiently access CHI product formularies across hundreds of cities in China. For commercial insurers, quality partnerships with PBMs will be essential to future product innovation and transition to the next-gen “product + service” model.

References:

- Critical Illness Insurance Market in China Research Report, 3/2022, Swiss Re Institute

- White Paper on China Commercial Health Insurance, E & Y, 2018

- China's Commercial Health Insurance, China Development Research Foundation, 2021

- The Road to Developing Critical Illness Insurance Under the New Regulations: Q&A with Tian Meipan, FSA, general manager of China Life Reinsurance Co., Ltd., The Actuary Magazine, January 2021