Access Pathway for Innovative Medicines in China: City Commercial Health Insurance ("Huiminbao")

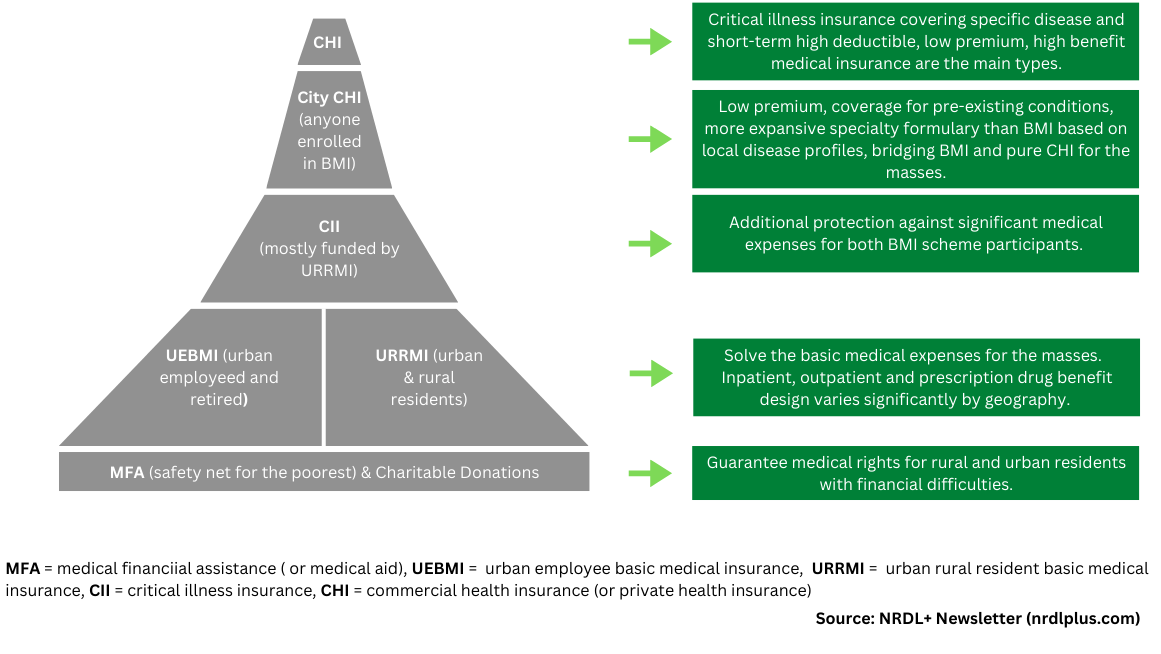

In the first installment of this 3-part China access pathway series, we discussed the basic social medical insurance (BMI)/the National Reimbursement Drug List (NRDL) route. This encore will focus on city commercial health insurance (City CHI).

Operated through a public-private partnership, positioned between BMI and pure commercial health insurance (CHI), city commercial health insurance aims to further alleviate out-of-pocket (OOP) expenses associated with inpatient services and specialty drugs for BMI participants. It is widely regarded as the starting point of all-inclusive commercial health insurance emerging in China, opening a brand-new private access pathway for innovative medicines previously non-existent in China.

Figure 1: China’s Multi-Layered Health Financing Ecosystem

Commercial Health Insurance for the Masses

City CHI’s design follows a “One City One Policy” model and is closely linked to local epidemiology, disease burden, reimbursement catalog, and economic development.

The all-inclusive nature of City CHI is reflected in its low premiums, lenient age, health restrictions (e.g., no age limit, coverage for pre-existing conditions), and meaningful high insurance coverage for inpatient stays and specialty drugs.

Initially introduced in Shen Zhen in 2015 as a form of supplementary insurance for critical illnesses designed to alleviate cost-sharing for BMI-covered services only, City CHI has undergone a transformation to encompass coverage for high-priced surgical materials, specialty drugs, and advanced treatments that are not covered by the basic social medical insurance schemes.

Most City CHIs also offer value-added services such as health checks, online medical consultation, critical illness outpatient green passes, and specialty drug delivery.

Over time, coverage for specialty drugs has become a hallmark of City CHI plans. For instance, 80% of City CHI products released between 2020 and 2022 offered outpatient coverage for cancer therapies that were outside the scope of BMI. Moreover, as of June 2022, various City CHI plans have covered 27 of the 40 cancer and rare disease drugs approved in 2021 by NMPA.

Growing at 21% annually, City CHIs have provided coverage for 140 million people across 27 provinces by the end of 2021 and are projected to reach 200 to 350 million people by 2025.

Strong Public-Private Partnership

The substantial growth of city commercial health insurance can be traced back to a critical moment in February 2020, when the State Council released the "Opinions on deepening the reform of the medical security system," signaling Beijing's backing for creating a multi-tiered medical security system, including further developing commercial health insurance, to ease the burden on BMI,

This policy backdrop has paved the way for a robust public-private partnership in developing, marketing, and managing city commercial health insurance products across hundreds of cities in China. As a result, it has significantly raised the awareness of commercial health insurance among Chinese consumers and simultaneously integrated commercial health insurers into China’s mainstream medical security system.

City CHI’s public-private partnership model can fall into two groups: government-led and commercial insurer-led. Key stakeholders and their respective roles and responsibilities typically are as follows:

Local Governments:

- Lead or support product design based on local epidemiology, disease burden, and reimbursement catalog.

- Offer policy support, such as allowing BMI participants to use their personal account balance to pay City CHI premiums, and

- Facilitate product promotion through government websites.

Commercial Insurance Companies:

- Design and underwrite City CHI products.

- Key players include but are not limited to Ping An Insurance, Zhong An Insurance, and China Life.

Pharmacy Benefit Managers (PBMs):

- Participate in drug formulary design and provide medication services.

- Key players are MediTrust, MedBanks, and Yuanxi Huibao.

Pharmaceutical Companies:

- Negotiate drug formulary.

- Manage risks (medication quality and safety).

- Major firms that have already taken advantage of the City CHI pathway include but are not limited to AstraZeneca, Pfizer, and Janssen.

Implications for Manufacturers

City commercial health insurance has significantly strengthened the private access pathways for innovative therapies in China. For the first time, manufacturers can leverage commercial health insurance offerings throughout the product life cycle to either complement or, in certain circumstances, substitute the NRDL route.

Similar to the old provincial reimbursement drug listing, inclusion in City CHI formularies pre-NRDL can help manufacturers generate local RWE data and garner KOL support, thus, negotiating from a position of strength during NRDL admission. For instance, seven specialty drugs listed in the 2021 edition of the Shanghai City CHI formulary (Huhuibao沪惠保) have been included in the NRDL.

Post NRDL, City CHIs, linked to local BMI catalogs, can further relieve BMI participants’ financial burden while helping drug makers optimize non-hospital channels.

Lately, as NRDL pricing pressure mounts, some innovative drug makers have exclusively elected to leverage commercial pathways for drug launches in China. Some have achieved impressive early results. For instance, cadonilimab (开坦尼), a first-in-class PD-1/CTLA-4 bi-specific immunotherapy drug approved in China in June 2022 for use in patients with relapsed or metastatic cervical cancer has reached 546 million yuan in sales within the first 6-months of launch and is expected to surpass one billion yuan in sales in 2023 independent of NRDL. As a context, China is ranked second in the cervical cancer incidence rate globally.

Another example is Fosun Kite’s Axicabtagene Ciloleucel, the first CAR-T cell therapy approved in China in June 2021, indicated for the treatment of adult patients with relapsed or refractory large B-cell lymphoma (r/r LBCL) after two or more lines of systemic therapy.

In part, the drug’s 1.2 million yuan per shot price tag reflects its late-line positioning in the treatment pathway, which implies a much smaller target patient population. As a result, the price-volume trade-off approach followed by NRDL negotiation proved challenging. And the first CAR-T treatment in China was excluded from the 2021 NRDL catalog.

Yet independent of NRDL, by July 2022, one year after approval, Axicabtagene Ciloleucel has already been listed in close to 100 commercial health insurance formularies, including 44 City CHIs, making CAR-T treatment accessible and affordable for Chinese patients.

Notably, the individual product attributes and competitive positioning were crucial to these manufacturers’ choice of access routes. Yet their successes, regardless of access routes, are rooted in one shared truth: a product superior in clinical value, targeting critical unmet needs.

References:

- City Supplementary Commercial Health Insurance, the Prospering Inclusive Solution for All, Access Health International, September 8th, 2021, https://fintechforhealth.sg/city-supplementary-commercial-health-insurance-the-prospering-inclusive-solution-for-all/

- Urban Customized Commercial Medical Insurance: Part 1, The Actuary Magazine, FAN SUXIA, November 2022, https://www.theactuarymagazine.org/urban-customized-commercial-medical-insurance-part-1/

- 2022年惠民保可持续发展趋势洞察|惠及1.4亿人次的惠民保,能否摆脱死亡螺旋?The China Pharmaceutical Industry Research and Development Association (PhIRDA) 【中国医药创新促进会】, 6/1/2022, http://www.phirda.com/artilce_28021.html?cId=1, (note: this one is on recent City CHI development, only available in Chinese.)

- Key success factors navigating the Asia Pacific market landscape for successful launch and commercialization (Web conference), IQVIA, 11/30/22

- 彪悍的创新药,选择甩开医保单干, PhIRDA, 3/20/23, http://www.phirda.com/artilce_30857.html?cId=1 (note: this is the case study for cadonilimab.)

- 《2022年城市定制型商业医疗保险(惠民保)知识图谱》, "2022 Urban Customized Commercial Medical Insurance (Hui Min Bao) Knowledge Graph", Fudan University

- 三款国产CAR-T上半年成绩出炉,药明巨诺开具77张处方, Sina Finance, 8/31/2022, https://baijiahao.baidu.com/s?id=1742689673802791898&wfr=spider&for=pc

- China's first CAR-T Cell Therapy approved-Fosun Kite Axicabtagene Ciloleucel (FKC876), FOSUN, 6/25/2021, https://en.fosun.com/content/details74_6674.html